As she scrubbed the colorful trays from which other students had eaten dinner, Melissa Cuddy worried about when she would have time to finish her psychology homework and begin studying for her midterm exam. She still needed to take out the trash and scrub the men’s urinals before getting off her shift at the crowded Carrillo Dining Commons.

“I had to do a lot of dirty work there. It made me appreciate what I had in life, but I am so happy I never have to do that again,” said Cuddy two years later.

Even though Cuddy worked during her time at the University of California, Santa Barbara, in 2013, she still walked the stage with her diploma and a handful of student debt. Today, she prepares to make her first student loan repayment towards her $22,925 loan.

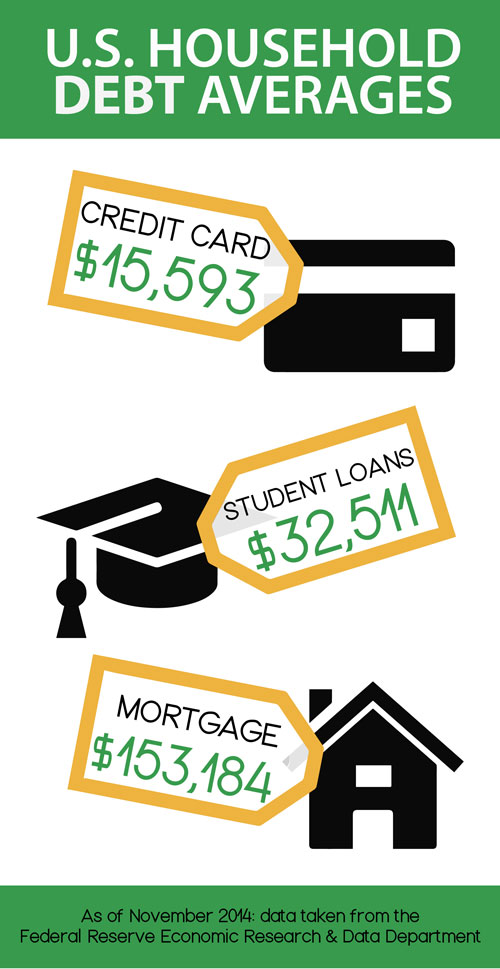

Melissa Cuddy is among many graduates with student debt. In fact, the class of 2014 was the most indebted graduating class ever, with an average loan debt of $33,000, according to a government data analysis at Edvisors.

But, student debt isn’t anything new. Cecilia Perez, a 43-year-old elementary school principal, still owes $23,000. While she received her undergraduate degree in 1996, Perez went back to school for multiple teaching credentials and a master’s degree.

Perez also worked during her college experience to financially support herself and tuition costs.

“It took me longer to graduate because some semesters I had to take less units than others due to my work schedule,” Perez said.

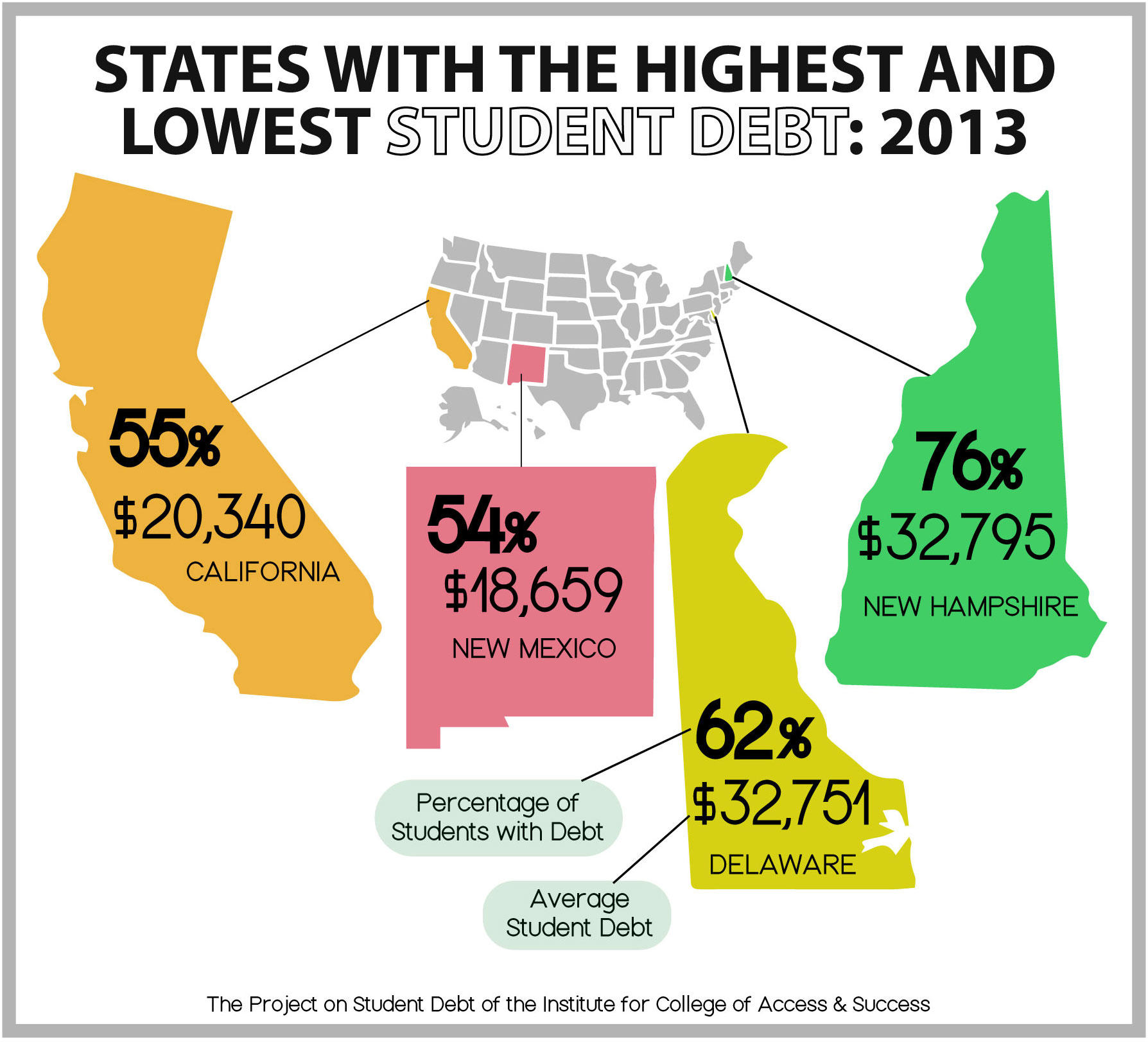

While both Cuddy and Perez worked during their time in college, today they both owe over the average debt amount for California college graduates. California has the second lowest student debt average across the nation, at $20,340, according to a recent study called The Project on Student Debt of the Institute for College Access and Success.

While student debt is at its highest ever, experts say it isn’t scaring away students from attending college.

“Our application numbers are at historic highs, and we think it will continue to have that trend,” said University of California spokeswoman, Brooke Converse.

Nancy Coolidge, a Policy and Legislative Analyst at the University of California, says that a higher education not only opens the doors for graduates to have more successful careers, but that it is also likely to pay you back and make you happy in the long run. She believes college is the greatest investment one can make.

“This is a risk worth taking. It’s a better risk than buying a home or buying a car, which are the two other main ways people invest,” Coolidge said.

Cuddy believes the risk was worth taking, but says she had a hard time finding a full-time job after college. Like many American graduates, Cuddy had to move back home with her parents upon graduation.

“It can be stressful living at home as a 23-year-old, but ultimately I think it’s the best choice until I find what I really want to do,” Cuddy said.

During Cuddy’s freshman year of college, her mother was diagnosed with breast cancer, and as a teen, her father was in a motorcycle accident that left him paralyzed from the waist down. Due to her family’s health, savings for college tuition were “drained by countless medical expenses.”

“Saving for college took a backseat to the realities of life,” Cuddy said.

Despite the hardships she faced, Cuddy knew that her education was important and that student debt is “just an unavoidable part of an adult life.”

In California alone, 55 percent of college students graduate with student debt, according to the Project on Student Debt.

While a six-month grace period is given to American’s after graduation, Cuddy still wasn’t able to make her payments and had to defer them for an extra year.

Since graduation, Cuddy has worked at various jobs, from a catering company and as a food runner, to a special education assistant and now as a part-time Applied Behavioral Analysis Therapist for the Autism Spectrum.

Cuddy’s first loan payment will be $245, about 11 percent of her monthly income. If she’s able to pay off the bare minimum monthly payments, she’s expected to pay off her total loans and interest by 2024. She says she was thankful for being approved for loans, but wishes she had qualified for more grants and applied to more scholarships.

“The grants were great, but I wish I had gotten more,” she said.

Nancy Coolidge of the University of California, says she believes California’s debt is lower than others mostly because of the financial aid and grant opportunities present in the sunny state. She says the Cal Grant is an enormous investment that the state taxpayers make, that has a large impact on student’s financial aid awards.

“It pays relatively low and middle-income students’ system wide tuition and fees at either CSUs and UCs, or at least makes a dent in their tuition at private institutions in California,” Coolidge said.

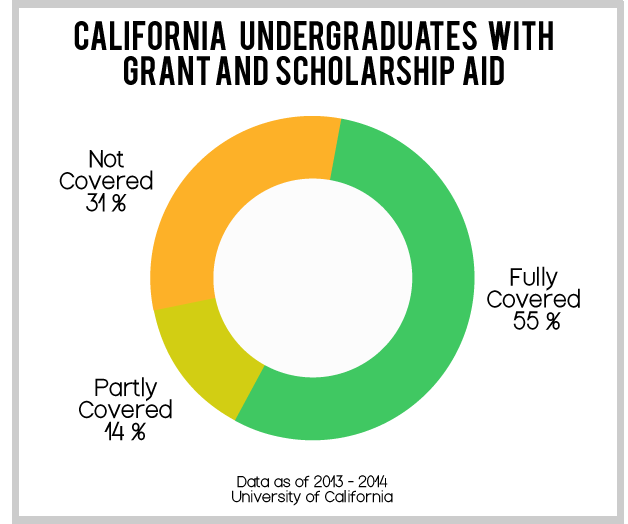

During the 2013/2014 school year, 55 percent of California undergraduates were fully covered under grant and scholarship aid. Fourteen percent were partly covered, leaving 31 percent without any funding, according to the University of California.

In order for students to receive this aid, they must file a FASFA or California Dream Act application, as well as some other requirements. While the Cal Grant distribution used to depend on the student’s grade point average, Coolidge says that these days the financial need of the student is the driver.

Since the Cal Grant funds a majority of California residents to attend California colleges, when a student chooses an out-of-state university, where tuition is typically double the price, the Cal Grant is not valid.

Melanie Cunningham, Director of Multicultural Recruitment at Pacific Lutheran University in Washington, says student debt is really dear to her heart. She says that since the university is a private school, tuition is extremely high. As an admission counselor, Cunningham sees the delicate balance between sales and counseling.

“If I am doing the math with a student and see they are going to need to take out student loans that’s going to put them over the national average, I ask them the question- How much is too much for you to pay for your bachelor’s degree?”

While Cunningham says the pressure to enroll students exists, she’s not interested in seeing students attend her college and then be laden with debt for a long time. At Pacific Lutheran University, to receive merit offers for funding, students have to have really good grades, or else students are looking at $18,000 per semester costs, and that’s without room and board.

“I also ask potential students if they think about going beyond their bachelors because loans are just going to add-on top of it,” Cunningham said.

Melissa Cuddy hopes to one day get a Master in Social Work or become a registered nurse. However, upon learning the tuition costs for graduate school and the little funding, she’s apprehensive.

“Tuition rates definitely play a role in my decision to go back to school, I’m not sure if I can really live with that much debt,” Cuddy said.

Nallely Gecik, a financial aid assistant director at Vanguard University, says that funding for graduate school is very limited, but there are ways to avoid student debt.

“I encourage graduate students to try to secure a full-time job to take advantage of any tuition remission or tuition benefits,” Gecik said.

Gecik received her bachelor's degree in Latino and Chicano Studies from the University of California, Santa Barbara. She then went straight on to graduate school at The New School in New York, where she worked full-time for the university her first year, receiving great benefits through the university.

She says she has completely paid off her undergraduate degree, but is still making payments towards her master’s degree.

“I don’t have much left to pay and they are very, very manageable payments. About $100 minimum payments each month,” Gecik said.

While Melissa Cuddy worries about the financial costs of graduate school, she thinks her bachelor’s degree in psychology is too broad and that she can’t really do much with it.

“I would tell any person that is about to attend college now, to go to a community college,” Cuddy said.

Cuddy added that while it might take you longer to get your degree, it is the best choice because you can spend more time deciding on your major, without feeling rushed and building up debt. With California’s large community college system, many students are choosing to decrease debt by being a transfer student.

Only 19 percent of full-time students at universities are earning their bachelor’s degrees in four years, according to a new report from Complete College America. With students spending more time in college, tuition fees begin to pile on.

Before transferring to UC, Santa Barbara, Cuddy had spent her freshman year at UC, Riverside, but wishes she had spent it at a community college.

“Although I cherish the friends and experiences I had there, it was a colossal waste of money,” Cuddy said.

While she believes her psychology degree is too broad, she’s thankful she got her degree when she did. Upon hearing about the University of California system increasing tuition prices, she’s thankful it won’t have much effect on her, unless she chooses a UC for graduate school.

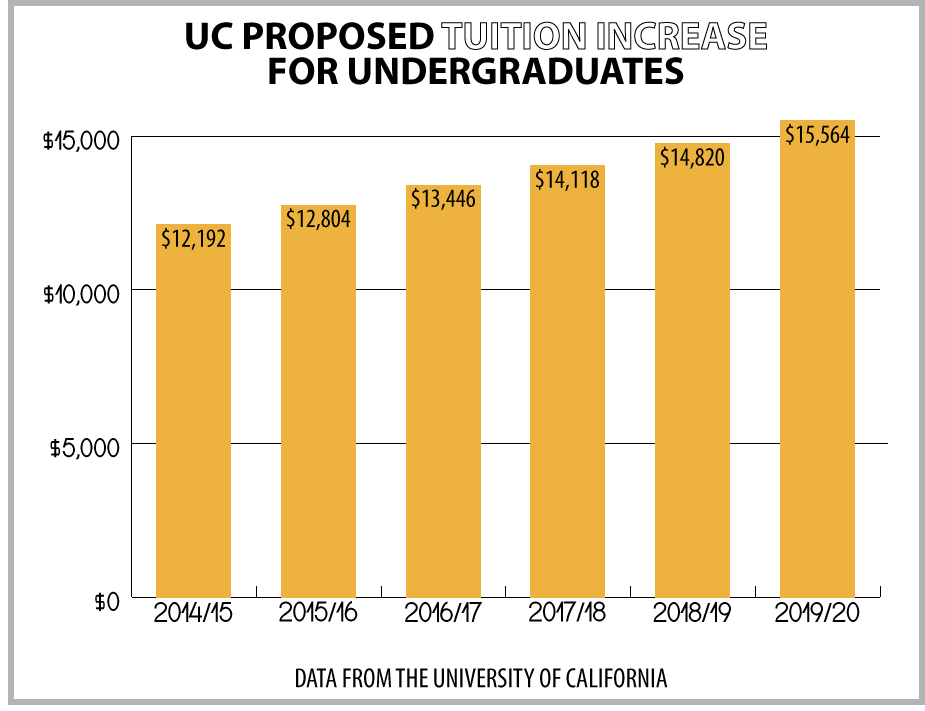

After three consecutive years without any tuition increases, University of California President, Janet Napolitano announced a new five-year plan that would increase tuition 5 percent each year for the next five years.

Cuddy explained that while the increase will be difficult for those in financial need, she doesn’t think it will discourage students from attending college.

“I think Californians understand the importance of higher education,” she said.

Chloe Massen, a senior at UC, Los Angeles studying sociology, is also thankful the tuition increase will not affect her.

“I feel like part of the last generation where college is somewhat accessible to the middle class. From here on out UC tuition will pretty much rival those of private schools,” Massen said.

Massen says it’s devastating to watch UC regents salaries rise along with the yearly tuition. Student across California who are also against the proposal, protested against the tuition increase.

Jessica Donham, a political science undergraduate at UC, Berkeley, is upset by the plan and has been extremely active in the marches and protests at her campus.

“The increase in fees and increase in students being admitted to this school is making a lot of students, me included, feel that our education is getting worse, yet costing us more,” Donham said.

According to the University of California, the proposed plan, which was voted 7-2 by the UC governing board, will allow 5,000 more California students to enroll over the next five years.

Donham says that at UC, Berkeley, there’s already not enough classes for students and admitting thousands of more students will only make it worse.

While many students see the tuition increase across the campuses as an extreme drawback, UC officials don’t think the proposal will have a negative effect on students.

“UC applications go up every year. In fact, just last year, UCLA received over 100 thousand applications, so we don’t see this having any impact on people who are applying to UC schools,” said UC spokeswoman, Brooke Converse.

Converse says that the level of funding the state of California provides is not enough for the UC system to sustain excellence, leading them to look at funding alternatives.

“Since the beginning of the financial crisis there have been layoffs, efficiencies, and cutbacks, and the University of California is starting to suffer because of that,” she said.

Besides admitting thousands of new students, the plan will also fund high-priority investments, such as reducing the student-faculty ratio, while maintaining the robust financial aid program.

UC Policy and Legislative Analyst, Nancy Coolidge says that UC colleges have more low-income students today than ever, and that the tuition increase won’t affect their grant awards.

“The financial aid award increases in proportion to the increase of tuition,” Coolidge said.

The financial aid award is not dependent on how much money is available from the state that year, but that it’s an entitlement, and students will get the award to which they are entitled.

The proposed increase would raise yearly tuition from the current amount of $12,192 to $15,564 by the 2019/2020 academic year.

Sarah Gosselin, a transfer student at UCLA, says that the proposal is not the best solution, and will still greatly affect those who take the community college route.

“Graduating as a transfer to a UC could cost over $30,000 for in-state students by the end of the 5-year hike,” she said.

Gosselin hopes that if the proposal does go through, that the funding will go towards sustaining high-caliber professors that may be getting recruited by private universities.

Melissa Cuddy says that the only way the tuition issue can be fixed is by providing more funds to the UC system. She believes that making the entire budget of the UC system transparent is necessary for future students to consider the tuition increase.

“Without transparency, there will be no way to keep the regents accountable for what is really being spent at each campus,” she said.

Whether the tuition proposal increases or not, it does not look like student debt will diminish anytime soon. Even though President Obama announced an executive action in June to expand eligibility years for the student loan forgiveness program, it only qualifies for graduates who work full-time in qualifying public sector or nonprofit jobs.

Until Melissa Cuddy is able to find a full-time job at a qualifying company, her new monthly loan payments will be a regular occurrence. While her interest may continue piling on, Cuddy’s resilience keeps her afloat. She said that her education is the one thing no one can take away from her.

“An education is worth more to me, then all of my loan payments combined,” she said.